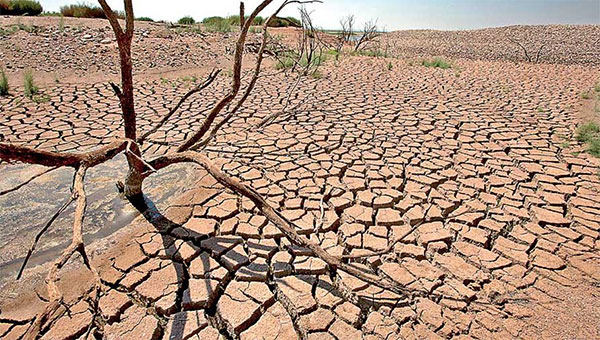

Sri Lanka’s debt restructuring efforts have reached a crucial juncture as negotiations with international creditors intensify. The country’s crippling debt burden, which stands at a staggering 129% of its GDP, has been a major factor in the ongoing economic crisis.

In recent weeks, there have been encouraging signs of progress towards a comprehensive debt restructuring agreement. Sri Lankan authorities have held multiple rounds of talks with representatives of various creditor groups, including bondholders, commercial lenders, and multilateral institutions like the International Monetary Fund (IMF).

The discussions have centered on key issues such as the extent of debt reduction, the grace period for repayments, and the interest rates on restructured bonds. While there have been disagreements on some aspects, both sides have expressed a willingness to compromise in order to reach a deal.

The IMF, which is playing a pivotal role in the debt restructuring process, has emphasized the need for a “deep and orderly” debt restructuring to restore Sri Lanka’s debt sustainability. The IMF’s Extended Fund Facility (EFF) program, worth $2.9 billion, is contingent on progress towards debt restructuring.

Despite the positive signals, there are still challenges to overcome. Some creditor groups have expressed concerns about the government’s proposed debt restructuring plan, arguing that it does not provide sufficient haircuts for bondholders.

Moreover, the political situation in Sri Lanka remains volatile, with ongoing protests against the government’s handling of the economic crisis. This could complicate the negotiations and make it more difficult to reach a consensus among creditors.

Despite these hurdles, there is a growing sense of urgency to conclude the debt restructuring process. The longer the issue drags on, the deeper the economic crisis will become. A successful debt restructuring would provide Sri Lanka with much-needed breathing room to pursue economic reforms and restore stability.

The next few weeks will be critical in determining the fate of Sri Lanka’s debt restructuring efforts. If the government and creditors can reach an agreement, it could pave the way for economic recovery and a brighter future for the country. However, if the negotiations fail to reach a resolution, Sri Lanka’s economic crisis could worsen, with severe consequences for its citizens.